Auto Academy

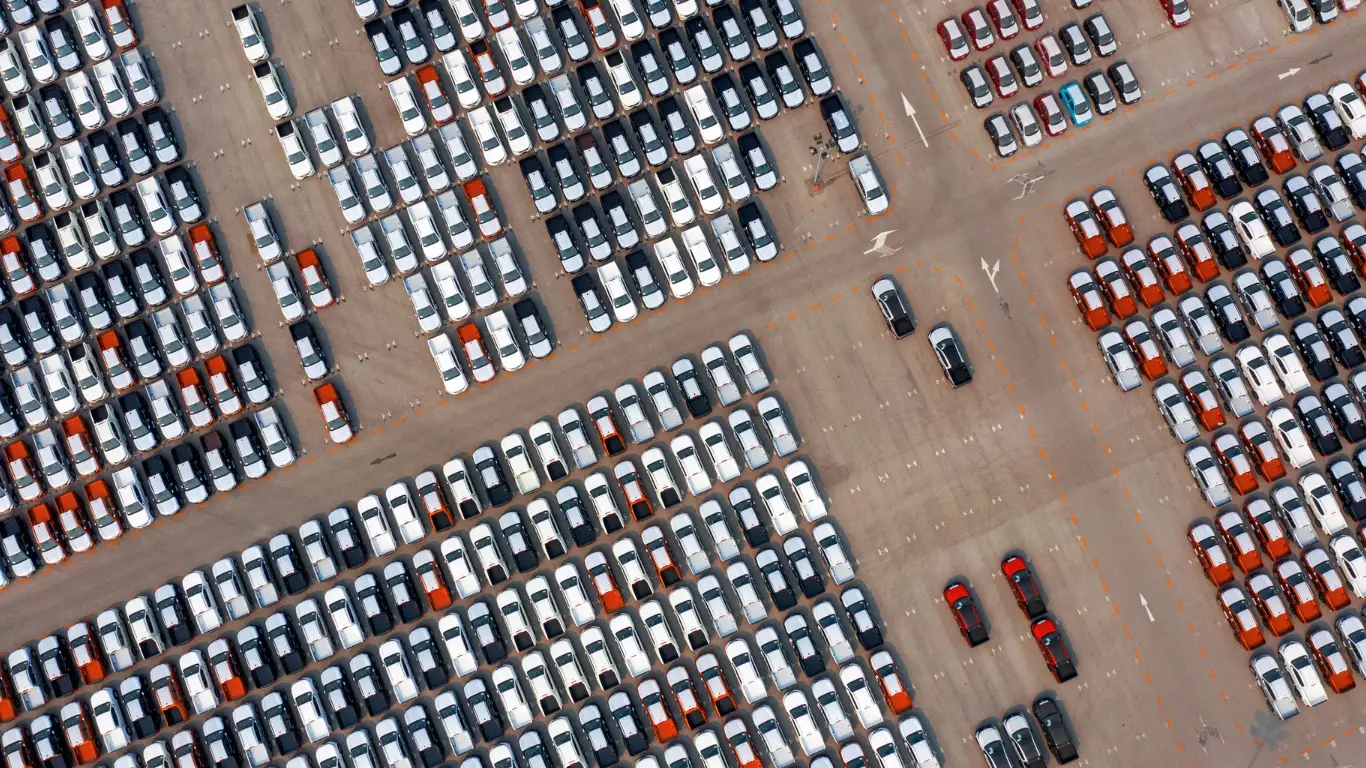

Canadian Used Car Wholesale Prices Drop Further: Market Insights July 2025

As we step into the second half of 2025, the Canadian used car wholesale prices continue to trend downward. The latest Canadian auto market insights for the week ending July 1, 2025, reveal a noticeable weekly used vehicle wholesale trend that reflects both broad and segment-specific depreciation across the board.

Here, we’ll break down the latest figures, examine segment performance (especially car vs truck/SUV segments), and highlight the ongoing used vehicle depreciation in Canada. Whether you’re an industry analyst or dealership strategist, these insights will help you navigate the rapidly changing landscape of automotive wholesale pricing in Canada 2025.

Canadian Used Car Wholesale Prices

Week-over-Week Wholesale Price Trends: All Segments

The chart below outlines the week-over-week wholesale price changes for 2–8-year-old vehicles across all segments, including cars, trucks, and SUVs.

Week-over-Week Price Change Summary (2–8-Year-Old Vehicles)

|

Vehicle Type |

Trend Line Color |

Notable Trend (Late June 2025) |

|

All Vehicles |

Black |

Slight decrease (~ -0.3%) |

|

Cars |

Blue |

Stable but trending lower |

|

Trucks/SUVs |

Red |

Larger fluctuations, slightly negative |

These fluctuations are consistent with overall weekly used car market decline in Canada, as values continue softening in response to both macroeconomic pressures and seasonal adjustments.

Car Segment Depreciation: Steady Declines Across the Board

The car category saw a 0.32% average weekly decline, equal to $117 in value. Sub-compact and full-size cars saw the most depreciation, while luxury models also posted moderate declines.

Car Segments – Weekly Change (Week Ending July 1, 2025)

|

Segment |

Weekly $ Change |

% Change |

|---|---|---|

|

Sub-Compact Car |

-$76 |

-0.69% |

|

Compact Car |

-$14 |

-0.09% |

|

Mid-Size Car |

-$53 |

-0.28% |

|

Full-Size Car |

-$133 |

-0.58% |

|

Near Luxury Car |

-$16 |

-0.05% |

|

Luxury Car |

-$186 |

-0.44% |

|

Prestige Luxury Car |

-$303 |

-0.54% |

|

Sporty Cars |

-$185 |

-0.63% |

|

Premium Sporty Car |

-$218 |

-0.25% |

|

All Cars |

-$117 |

-0.32% |

These figures underscore the used vehicle depreciation in Canada, especially within performance and full-size segments.

Canadian Used Car Wholesale Prices

Truck and SUV Segment Analysis: Value Drops in Most Segments

For the 2025 Canadian truck and SUV wholesale value trends, the data shows an average 0.32% weekly decrease, equivalent to a $106 drop overall. Minivans were hit hardest, while a few segments like compact vans and mid-size luxury crossovers defied the trend with slight gains.

Truck/SUV Segments – Weekly Change (Week Ending July 1, 2025)

|

Segment |

Weekly $ Change |

% Change |

|

Sub-Compact Crossover |

-$60 |

-0.35% |

|

Compact Crossover/SUV |

-$91 |

-0.40% |

|

Mid-Size Crossover/SUV |

-$4 |

-0.02% |

|

Full-Size Crossover/SUV |

-$299 |

-0.69% |

|

Sub-Compact Luxury Crossover/SUV |

-$57 |

-0.18% |

|

Compact Luxury Crossover/SUV |

-$84 |

-0.20% |

|

Mid-Size Luxury Crossover/SUV |

+$28 |

+0.11% |

|

Full-Size Luxury Crossover/SUV |

-$842 |

-1.20% |

|

Minivan |

-$100 |

-0.46% |

|

Compact Van |

+$68 |

+0.26% |

|

Full-Size Van |

-$47 |

-0.13% |

|

Small Pickup |

-$78 |

-0.25% |

|

Full-Size Pickup |

-$116 |

-0.29% |

|

All TRUCKS/SUVs |

-$106 |

-0.32% |

The Canadian SUV truck segment wholesale price drop—especially the steep fall in full-size luxury crossovers—drives much of the overall negative movement in the Canada used wholesale prices week ending July 2025.

Comparing Car vs Truck/SUV Wholesale Trends

Looking at the car segments vs truck segments wholesale in Canada, both posted a 0.32% decline this week. However, trucks and SUVs exhibit more volatility, with sharp declines in some sub-categories and small gains in others.

Summary Comparison

|

Category |

Avg $ Change |

Avg % Change |

Volatility |

|

Cars |

-$117 |

-0.32% |

Moderate |

|

Trucks/SUVs |

-$106 |

-0.32% |

High (esp. luxury) |

This comparison reflects a broader pattern in the Canadian auto wholesale market analysis where higher-end vehicles—especially premium SUVs—are more sensitive to shifts in buyer demand and economic pressures.

What This Means for the July 2025 Canadian Used Car Market

The July 2025 Canadian used car market continues to show signs of cooling, with both cars and trucks/suvs experiencing depreciation in wholesale pricing. Inventory normalization, consumer hesitation, and high financing costs contribute to the persistent softening in values.

Dealers and buyers should continue to monitor the Canada used vehicle price index and adapt strategies accordingly. Short-term pricing movements can create buying opportunities, particularly in segments like mid-size luxury crossovers, which saw minor gains despite the general decline.

Final Thoughts: Wholesale Price Outlook for Summer 2025

Now, all eyes will remain on the truck and SUV wholesale value trends in Canada, as well as used vehicle depreciation Canada-wide. For dealerships like CarRookie in Toronto, staying informed by monitoring these weekly used vehicle wholesale trends through reliable sources like Canadian Black Book is crucial to navigating this evolving wholesale landscape.

Whether you’re evaluating automotive wholesale pricing across Canada in 2025 or planning your next inventory acquisition, understanding the data behind the numbers is key to making smart, timely decisions that keep your dealership competitive and responsive to market shifts.